Iss article ko full screen mein padhne ke liye, kripya yahan click karein.

Payment verification ke proof |

|

Kuch cases mein, aapko platform par deposit karne ke liye apne payment methods verify karne padenge. Aap jo documents upload karenge, wo aapke payment method par depend karte hain. Generaly, document mein aapka full name, deposit ki date, aur amount dikhna chahiye. |

|

Apna payment method select karein taaki aapko required documents check karne mein madad mile. |

Astropay

Aapko AstroPay ki web page ka ek screenshot upload karna padega jisme aapka full name aur platform par deposit clearly visible ho.

Dhyaan dein ki screenshot AstroPay ke web version se liya gaya ho. Hum strongly recommend karte hain ki aap full screenshot upload karein bina kisi digital editing ya cropping ke.

Yahaan ek example diya gaya hai ki kaise lagna chahiye:

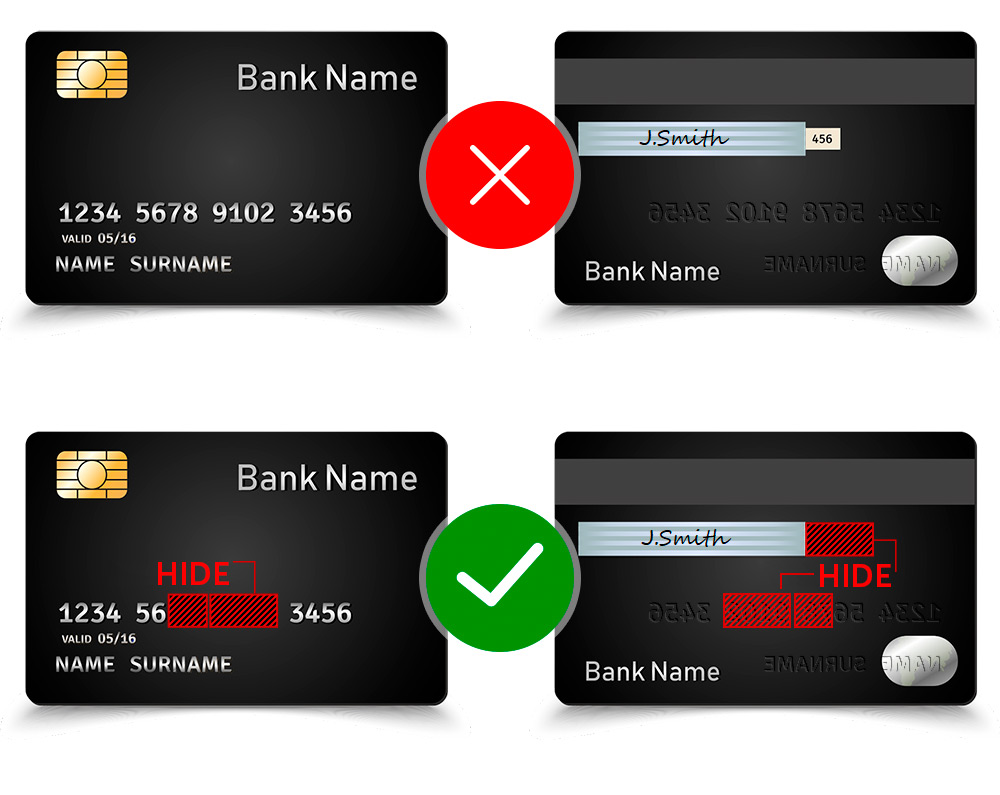

Bank Cards

Aapko apne card ki photo upload karni hogi jisme ye information visible honi chahiye:- Card ke pehle 6 aur aakhri 4 digits.

- Expiration date.

- Cardholder ka naam.

Card ke pichle hisse aur baki information ko cover kar sakte hain.

|

Kya aapka naam card par nahi hai? |

Agar aapke bank card par aapka naam nahi dikh raha, to aap inmein se koi ek document upload kar sakte hain:

- Online banking system ka screenshot jisme aapka naam aur platform par ki gayi deposit visible ho.

- Bank statement jisme aapka naam aur platform par ki gayi deposit visible ho.

Hum recommend karte hain ki aap full bank statement PDF version mein upload karein.

Yahaan ek example diya gaya hai:

| E-card ko verify kaise karein? |

E-card ko verify karne ke liye, aap inmein se koi ek document upload kar sakte hain:

- Aapke virtual card ka screenshot jisme aapka naam, pehle 6 aur aakhri 4 digits, aur aapke card ki expiration date visible ho.

- Online banking system ka screenshot jisme aapka naam aur platform par ki gayi deposit visible ho.

- Bank statement jisme aapka naam aur platform par ki gayi deposit visible ho.

Dhyaan rahein ki document mein aapka full name aur platform par ki gayi deposit ki date aur time hona chahiye. Saari information clear aur focus mein honi chahiye.

Yahaan ek example diya gaya hai:

| Blocked or stolen card ko verify kaise karein? |

Blocked ya stolen card ko verify karne ke liye, aapko chinta karne ki zarurat nahi hai! Aap inmein se koi ek official document apne bank se provide kar sakte hain:

- Bank statement jisme aapka naam aur platform par ki gayi deposit visible ho.

- Online banking ka screenshot jisme aapka card number aur naam ho.

- Aapke bank se ek letter jisme bataya gaya ho ki aapka card kyun block hua.

Dhyaan rahein ki document mein aapka full name aur card number hona chahiye. Saari information clear aur focus mein honi chahiye.

BKash

Aapko neeche diye gaye documents upload karne honge:

- BKash profile page ka screenshot jisme aapka BKash account number aur name clearly visible ho.

- Platform par deposit ka screenshot. Isme account number, date, aur amount visible honi chahiye.

Hum strongly recommend karte hain ki aap full screenshots upload karein bina kisi digital editing ya cropping ke.

Yahaan kuch examples diye gaye hain jaisa dikhna chahiye:

Yeh recommend kiya jata hai ki aap full statement PDF format mein upload karein. Dhyaan rahein ki aap sirf web version se PDF upload kar sakte hain. Aap apni statement BKash Customer Support se sampark karke prapt kar sakte hain.

Easypaisa

Hum recommend karte hain ki aap apne sabse recent deposit ka screenshot upload karein. Yeh aap app se seedha photo ya PDF ke roop mein download kar sakte hain.

| Screenshot kaise lein? |

- App ke home screen par apne balance par tap karein.

- 'Transaction History' par click karein, platform par ki gayi transaction ko select karein, aur phir 'View' par click karein.

Internet Banking / Bank Transfer

Aapko apne bank statement ya transaction history ka PDF ya screenshot upload karna hoga. Iss statement mein ye details honi chahiye:

- Aapka full name

- Bank account number

- Platform par ki gayi aakhri transaction ki date aur amount

Hum strongly recommend karte hain ki aap full screenshots upload karein bina kisi digital editing ya cropping ke.

Yahaan ek example diya gaya hai ki kaise dikhna chahiye:

Hum recommend karte hain ki aap ek hi document upload karein jisme saari information ho. Agar yeh possible na ho, to aap neeche diye gaye documents upload kar sakte hain:

- Internet Banking ka screenshot jisme aapka account number aur full name visible ho.

- Deposit ka screenshot jisme account number, date, aur amount visible ho.

Internet Banking home page |

|

Platform se deposit |

|

IMPS

Aapko sirf ek bank statement upload karni hogi. Is statement mein ye details honi chahiye:

- Aapka full name

- Bank account number

- Platform par ki gayi aakhri transaction ki date aur amount

Yahaan do examples diye gaye hain jaisa dikhna chahiye:

|

|

| Recommendations bank statement ke liye |

-

Kripya dhyaan dein ki aapka full name aur account number ek saath visible hona chahiye.

-

Yeh recommend kiya jata hai ki aap full statement PDF format mein upload karein. Dhyaan rahein ki aap sirf web version se PDF upload kar sakte hain.

-

Aap apni bank statement asaani se apne bank ke app ya website se download karke prapt kar sakte hain.

MobiKwik

Hum strongly recommend karte hain ki aap full screenshots upload karein bina kisi digital editing ya cropping ke.

| Profile page kaise dikhna chahiye: | Deposit kaise dikhna chahiye: |

|

|

Nagad

Aapko Nagad statement upload karni hogi, jisme aapka naam aur platform par ki gayi transaction included ho.

Hum strongly recommend karte hain ki aap document ko bina kisi digital editing ya cropping ke upload karein.

Yahaan ek example diya gaya hai ki yeh kaise dikhna chahiye:

Neteller

Aapko Neteller ke transaction history ka screenshot upload karna hoga jisme yeh sab details visible honi chahiye:

- Full name

- Wallet number

- Registered email

- Platform par ki gayi deposit ki date aur amount

Hum strongly recommend karte hain ki aap full screenshots upload karein bina kisi digital editing ya cropping ke.

Yahaan ek example diya gaya hai ki yeh kaise dikhna chahiye:

| Transaction history ka screenshot kaise lein? |

- Aap apne Neteller profile page par login karein.

- Menu par ‘History’ par click karein.

- Transaction type aur date ko filter karein taaki platform par ki gayi deposit visible ho.

- ‘Profile’ icon par click karein.

Ek screenshot lein jisme transaction data aur profile window ek saath visible hon.

Phone Payments

| Option 1 |

Aap yeh upload kar sakte hain:

- Deposit ka screenshot jisme date, amount, aur bank account visible ho.

- Aapka bank passbook ka photo jisme aapka name aur account number ho, ya phir bank statement jisme aapka name aur platform par ki gayi transaction ho.

Yahaan kuch examples diye gaye hain jaisa dikhna chahiye:

|

|

| Option 2 |

Aap apna bank account statement upload kar sakte hain jo aapke Phone Payment se linked hai, jisme yeh details visible honi chahiye:

- Your full name

- The bank account number

- The date aur amount of the last transaction made to the platform

Yeh recommend kiya jata hai ki aap full statement ko PDF format mein upload karein. Aap sirf web version of the platform se hi PDF upload kar sakte hain. Aapka bank statement pane ka sabse asan tareeka hai ki aap ise apne bank ke app ya web page se download karein.

Yahaan kuch examples diye gaye hain jaisa dikhna chahiye:

Rocket

Aapko Rocket statement upload karna hoga, jisme aapka name aur transaction data (date aur amount) visible ho.

Hum strongly recommend karte hain ki aap document ko bina kisi digital editing ya cropping ke upload karein.

Yahaan kuch examples diye gaye hain jaisa dikhna chahiye:

Skrill

Aapko Skrill transaction history ka ek screenshot upload karna hoga jisme yeh sab visible ho:

- Full name

- Wallet number

- Registered email

- Platform par ki gayi deposit ka date aur amount

Hum strongly recommend karte hain ki aap full screenshots upload karein bina kisi digital editing ya cropping ke.

Yahaan ek example diya gaya hai ki yeh kaise dikhna chahiye:

| Transaction history ka screenshot kaise lein? |

- Apne Skrill profile page par log in karein.

- Menu par ‘History’ par click karein.

- Transaction type aur date ko filter karein taaki platform par ki gayi deposit visible ho.

- ‘Profile’ icon par click karein.

Volet

Aapko do screenshots upload karne honge:

- Advcash profile page ka screenshot, jisme aapka ADVcash account number aur name visible ho.

- Platform par ki gayi deposit ka screenshot, jisme account number, date, aur amount visible ho.

Hum strongly recommend karte hain ki aap full screenshots upload karein bina kisi digital editing ya cropping ke.

Yahaan ek example diya gaya hai ki platform par ki gayi deposit ka screenshot kaise dikhna chahiye:

UPI

| Option 1 |

Aap yeh upload kar sakte hain:

- Deposit ka screenshot, jisme date, amount, aur bank account visible ho.

- UPI-linked bank passbook ka photo jisme aapka name, bank account number, date, aur platform par ki gayi last transaction ka amount ho.

Yahaan kuch examples diye gaye hain jaisa dikhna chahiye:

|

|

| Option 2 |

Aap apna UPI-linked bank account statement upload kar sakte hain jisme yeh details ho:

- Aapka full name.

- Bank account number.

- Platform par ki gayi last transaction ki date aur amount.

Hum recommend karte hain ki aap full statement ko PDF format mein upload karein. Aap sirf web version se hi PDF upload kar sakte hain. Aap apna bank statement aasani se apne bank ki app ya website se download kar sakte hain.

Yahaan kuch examples diye gaye hain jaisa dikhna chahiye:

WebMoney

Aapko Webmoney e-wallet ke web version ka screenshot upload karna hoga jisme yeh information dikhai deni chahiye:

- Aapka name

- Webmoney passport type

Yeh ensure karein ki aapka Webmoney e-wallet verification pass kar chuka hai aur Formal passport hai. Hum recommend karte hain ki aap document ko digital editions ya cropping ke bina upload karein.

Yahaan ek example diya gaya hai jaisa aapka profile page dikhna chahiye:

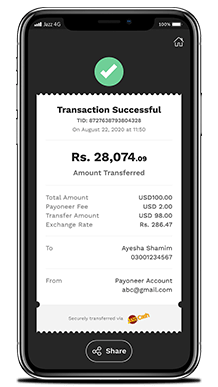

Jazzcash

Aapko platform par apne deposit ka screenshot upload karna hoga. Is screenshot mein yeh cheezein dikhai deni chahiye: aapka name, transaction ID aur deposit amount.

Hum recommend karte hain ki aap apne most recent deposit ka full screenshot upload karein bina kisi digital editions ya cropping ke. Yeh screenshot aap app se photo ya PDF ke roop mein seedha download kar sakte hain.

Yahaan ek example diya gaya hai jaisa aapka screenshot dikhna chahiye:

Ummeed hai aapko iss jankari se madad prapt hui hogi ! Yadi aapko jankari pasand aayi toh hamein 👍 karein.

Help Center

Help Center